What Predetermined Overhead Rate Is Formula and Sample

Conversely, the cost of the t-shirts themselves would not be considered overhead because it’s directly linked to your product (and obviously changes based on the volume of products you create and sell). Fixed costs are those that remain the same even when production or sales volume changes. So if your business is selling more products, you’ll still be paying the same amount in rent. Keeping overhead costs in check can have a notable impact on the bottom line. Optimize processes – Streamline workflows around everything from inventory to invoicing to save time and cut labor costs. This comprehensive guide breaks down overhead rate calculation into clear, actionable steps any business can follow.

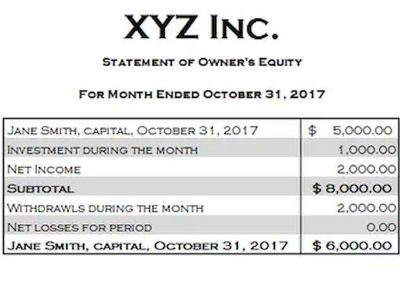

The Company

- The overhead rate is a cost added on to the direct costs of production in order to more accurately assess the profitability of each product.

- Using a predetermined overhead rate allows companies to apply manufacturing overhead costs to units produced based on an estimated rate, rather than actual overhead costs.

- If the predetermined overhead rate calculated is nowhere close to being accurate, the decisions based on this rate will definitely be inaccurate, too.

- The overhead rate has limitations when applying it to companies that have few overhead costs or when their costs are mostly tied to production.

- Obotu has 2+years of professional experience in the business and finance sector.

Similarly, as mentioned above some businesses may use it as a monitoring and control tool. If the predetermined overhead rates are not accurate, they can force the business to control its activities according to unrealistic rates. Furthermore, when actual costs are compared to the budgeted costs based on predetermined overhead rates, the variances may be too significant. Let’s consider a fictional company, XYZ Furniture, that manufactures wooden tables.

- The best way to predict your overhead costs is to track these costs on a monthly basis.

- Discover the top 5 best practices for successful accounting talent offshoring.

- (b) Alternatively, we use machine hour rate if in the factory or department of the production is mainly controlled or dictated by machines.

- The overhead rate allocates indirect costs to the direct costs tied to production by spreading or allocating the overhead costs based on the dollar amount for direct costs, total labor hours, or even machine hours.

- Hence, this predetermined overhead rate of 66.47 shall be applied to the pricing of the new product VXM.

- Since overhead costs cannot be easily traced to individual products like direct material or labor costs, overhead rates help to allocate a fair share of these costs based on the activity of making the product.

Formula

However, since budgets are made at the start of the period, they do not allow the business to use https://www.bookstime.com/ actual results for planning or forecasting. Therefore, the business must use a predetermined overhead rate to budget its expenses for the future. One of the advantages of predetermined overhead rate is that it can help businesses monitor overhead rate. A business can calculate its actual costs periodically and then compare that to the predetermined overhead rate in order to monitor expenses throughout the year or see how on-target their original estimate was. This comparison can be used to monitor or predict expenses for the next project (or fiscal year).

Predetermined Overhead Rate Formula

Hence, one of the major advantages of predetermined overhead rate formula is that it is useful in price setting. The controller of the Gertrude Radio Company wants to develop a predetermined overhead rate, which she can use to apply overhead more quickly in each reporting period, thereby allowing for a faster closing process. A later analysis reveals that the actual amount that should have been assigned to inventory is $48,000, so the $2,000 difference is charged to the cost of goods sold. Now ABC Co. can compare its estimated results with actual results to evaluate how it has performed. However, whether ABC Co. made a profit or loss on the actual job can only be determined if the price of the job is known.

- At this point, do not be concerned about the accuracy of the future financial statements that will be created using these estimated overhead allocation rates.

- For businesses in manufacturing, establishing and monitoring an overhead rate can help keep expenses proportional to production volumes and sales.

- For example, the office rent mentioned earlier can’t be directly linked to any one good or service produced by the business.

- Once the units to be produced or activity base has been estimated, the business must then estimate its total manufacturing costs based on the number of units to be produced.

- This chapter will explain the transition to ABC and provide a foundation in its mechanics.

As the production head wants to calculate the predetermined overhead rate, all the direct costs will be ignored, whether direct cost (labor or material). The predetermined overhead rate is used to price new products and to calculate assets = liabilities + equity variances in overhead costs. Variances can be calculated for actual versus budgeted or forecasted results. Direct costs are costs directly tied to a product or service that a company produces.

It would involve calculating a predetermined overhead rate known cost (like Labor cost) and then applying an overhead rate (which was predetermined) to this to project an unknown cost (which is the overhead amount). The formula for calculating Predetermined Overhead Rate is represented as follows. The equation for the overhead rate is overhead (or indirect) costs divided by direct costs or whatever you’re measuring. Direct costs typically are direct labor, direct machine costs, or direct material costs—all expressed in dollar amounts. Each one of these is also known as an “activity driver” or “allocation measure.”