Finance out of Relatives and buddies How they Functions as well as the Required Records

Finance out-of Relatives and buddies: The first port off call for borrowing currency to own startups was relatives and buddies. Over the years, promissory notes enjoys acted as the a variety of personally provided currency. They go back into the newest old Chinese dynasties and were launched so you’re able to Europe by the Marco Polo.

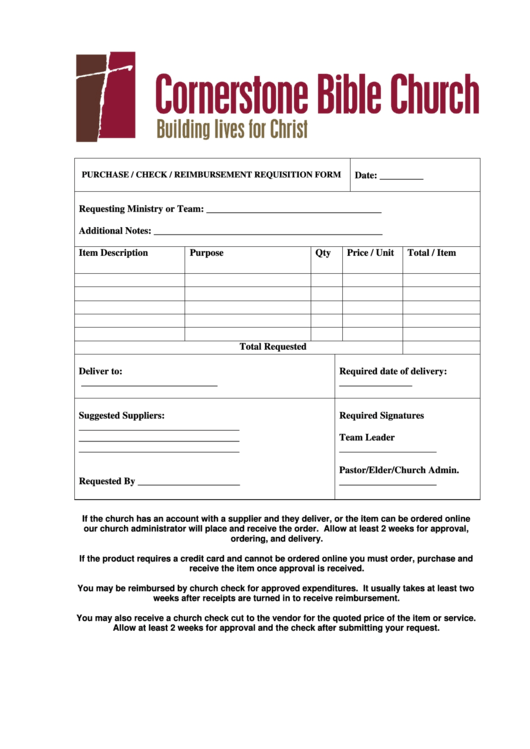

The picture to the right are of a great promissory note out of another Financial of your You inside 1840. They’re not therefore fairly more and can be merely penned documents, rightly closed amongst the parties.

Fund off relatives and buddies are definitely the most significant amount off business fund after the founder’s very own financing or unsecured loans. One to analysis put the proportion within 38% of all business financial support. What ever this new ratio was, it is certainly extremely extreme.

Promissory Notes getting Financing regarding Relatives and buddies

While you are matchmaking tends to be enough to get the service, the actual transaction out-of finance from friends should be done right, or else you will not only damage the firm, however, tough, you are going to damage those people relationships. If you do use regarding friends and family, then the techniques is pretty quick. Attempt to set up a good promissory mention to set they down from inside the a legally joining means for both sides. The loan would be shielded (facing a secured item) otherwise unsecured.

Finance out of Friends-List

- new activities toward loan, the amount therefore the interest;

- terms of repayment-periodic: normal amounts across the identity also funding and notice; balloon: typical levels of quicker proportions having a big terminal fee; lump sum: most of the financing and you will desire during the name;

- people fees for late payments and in what way they are so you can feel addressed;

- where and exactly how costs can be made;

- punishment (or otherwise not) getting early settlement;

- what takes place regarding default towards the mortgage;

- shared and some liability;

- modification techniques (if the arranged or perhaps not);

- transferability of the mortgage;

Totally free Promissory Mention Layouts

Favor or tailor a good promissory remember that meets your needs and if you possess the smallest hesitance throughout the signing, work at they by your lawyer. Discuss the criterion into the each party for your funds regarding family members and you can members of the family, before you can invest in just do it. You can buy free templates away from:

Getting a startup it’s also possible to prefer a modifiable promissory notes having fund out of relatives and buddies. They can be attractive to individuals who are perhaps not romantic participants of your family unit members or even more members of the family out-of relatives than just your pals. Such as loan providers may want to have a way to participate in the latest upside of the new venture. The fresh convertible promissory notes is actually modifiable to your guarantee during the a later date, depending upon trigger including types of amounts of revenue otherwise funds are attained.

To pay these a lot more arms length people for the risk they was bringing, the brand new cards ended up selling are often modifiable at a discount toward cost of the next preferred security bullet and will also contain a good cap’ or a maximum conversion price-into rate of which brand new note will later convert.

Convertible notes are sometimes preferred by both entrepreneurs and dealers, because it’s so difficult to put an admiration about what is named an excellent pre-money (prior to external funding and you can/otherwise in advance of exchange has revealed a reputation)

Crowdfunding-an alternative to Fund out-of Family and friends

There are many pathways to help you money a startup apart from fund out-of family and friends. They need a little more than just and make calls. Widely known is to utilize crowdfunding, either using advantages otherwise equity crowdfunding. Advantages crowdfunding comes to your when you look at the a plenty of selling performs and you can deciding what sort of reward you might provide.

Security crowdfunding is really different, when you are requesting fund friends and family (and possibly people you never see physically) while making a good investment, instead of giving you a gift (perks crowdfunding), or making financing that might be paid, when it concerns repaying interest or not. We have discussed collateral crowdfunding and introduced a preliminary list out of collateral crowdfunding platforms. Take a look.