Ought i pay back a property improvement mortgage early?

Family recovery strategies would be costly. However, property improvement financing provide tall economic pros. This type of financing usually promote straight down interest levels than solutions such credit cards or signature loans, making them a more prices-productive capital choice.

From the opting for a house update loan, home owners is also end racking up higher-interest debt and you will save money on focus will cost you across the lifestyle of the loan. Likewise, of a lot do it yourself finance include flexible fees conditions, making it simpler getting borrowers to deal with its earnings.

Likelihood of Foreclosures

Safeguarded do it yourself finance, instance home collateral otherwise HELOCs, use your household since equity. For people who default in these funds, the lender is foreclose at your residence. Property foreclosure besides leads to losing your property but has also really serious monetary and you can borrowing from the bank outcomes.

Property foreclosure can also be straight down a good borrower’s credit rating and take ten years to recoup economically. Additionally, the loss of family collateral can impede upcoming borrowing or refinancing opportunities.

Debt burden

Taking up a lot more debt that have a house upgrade loan function you can need to make monthly obligations, that will filters your financial allowance otherwise properly organized. Simultaneously, they frequently incorporate longer cost terms, either comprising age. It means you’re going to be invested in settling the borrowed funds to possess a serious portion of your upcoming.

Additionally, racking up even more loans owing to these types of fund make a difference to the creditworthiness and you will credit convenience of almost every other ventures. Hence, if you’re such finance render a handy answer to financing home improvements,

Possible More than-Leverage

Lenders put restriction mortgage wide variety considering your income, creditworthiness, and you will household collateral. Borrowing from the bank past this type of restrictions can also be strain your money and you may ability to pay-off the borrowed funds. Also, using up a significant portion of your house equity could get off you with little to have upcoming means or issues, such needed repairs or unforeseen expenses.

Interest Will set you back

Attention prices are a disadvantage once you funds a home restoration using a home improve mortgage. This type of can cost you accrue along the loan label, affecting the total bills. The amount you pay for the desire depends on circumstances particularly the borrowed funds count together with prevailing interest rate.

Such as, a higher loan or interest rate can result in significantly highest notice costs through the years. At the same time, these types of fund routinely have fixed or adjustable interest rates, for each and every with its implications to have fees.

Property value Motion

House restoration programs funded of the a property update loan can enhance worth of. Although not, it’s essential to acknowledge new built-in danger of value of activity. Areas are inclined to financial alter and shifts inside the consult, which can affect the return on the investment from home home improvements.

While particular improvements such as for instance cooking area remodels or restroom enhancements tend to give highest productivity, other people might not fully recover the can cost you. For instance, trendy has might not align with markets choices for the certain urban area. Moreover, the time out of household home improvements prior to field criteria significantly affects its monetary effect.

Summing It

Having fun with a home improve loan to have renovations provides the advantageous asset of opening fund to compliment your own residence’s worth and features. Yet not, weigh advantages and downsides very carefully and you can given your financial situation, specifications, and you will exposure threshold prior to taking towards the additional loans is very important.

Knowing the prospective pros and cons away from do it yourself finance is also help you make a knowledgeable choice that aligns along with your demands and you may priorities. Consulting with monetary advisors otherwise mortgage pros also have worthwhile information to own home improvement investment.

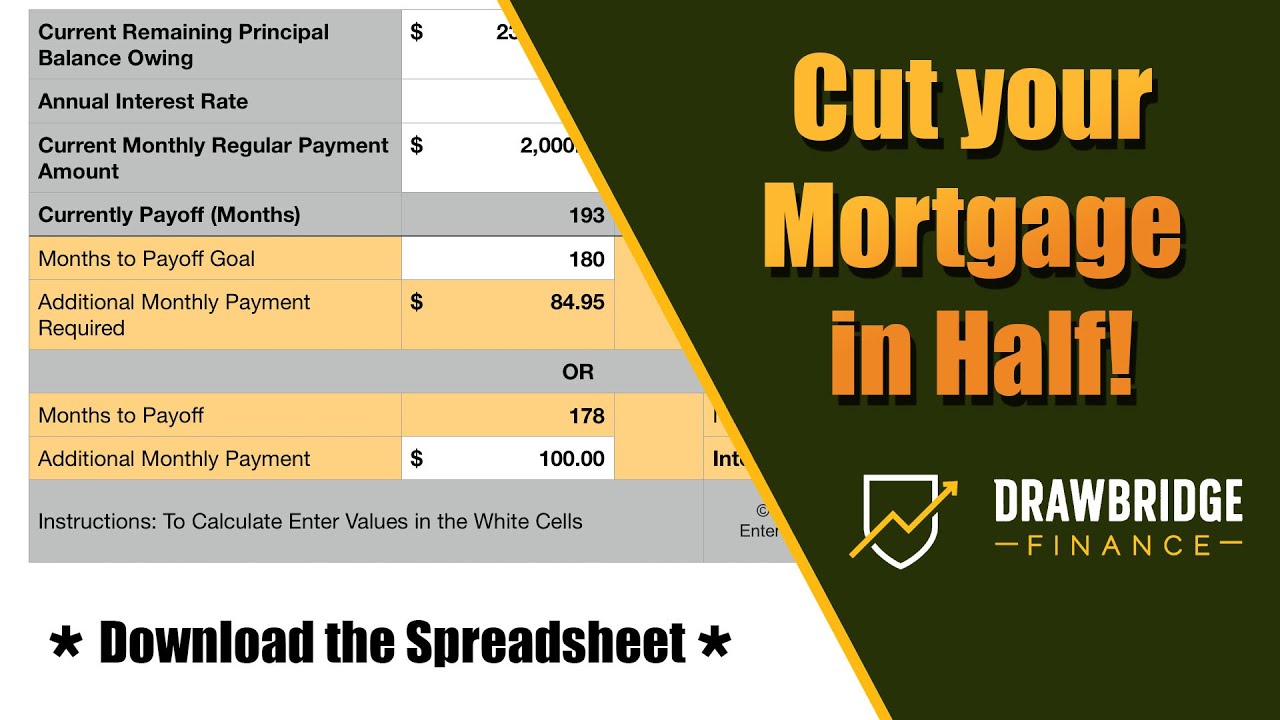

Yes, you could constantly pay that it financing early. not, check your financing terms for all the prepayment charges. Paying your loan early will save you cash on attract, particularly if the loan try enough time-name.