The way we chose the ideal boat funds

Ideas on how to examine motorboat finance

When investigating financing options, there are certain techniques take into consideration, including annual fee pricing, conditions, numbers and you can qualifications standards. Of the evaluating watercraft mortgage has the benefit of, you can pick a loan provider one most closely fits debt needs and you may funds.

Yearly commission pricing

An excellent loan’s apr (APR) tips how much you will be charged you to borrow money. Which amount has both rate of interest and charge. The better your credit rating, the low their Annual percentage rate may be.

Repayment terms

The installment terms and conditions indicate just how long you have got to pay-off your ship mortgage. The longer your label try, the low your monthly payment are going to be. not, you can also shell out far more into the attract that have an extended mortgage . The brand new reduced the loan name was, the better their payment per month can be, however could possibly get save money on notice.

Financing amounts

What kind of cash a yacht bank was prepared to give your hinges on your credit rating and you may history, your income additionally the worth of your motorboat. If you need an enormous loan amount, some lenders might require which you fulfill highest money and you may credit rating thresholds.

Qualifications criteria

Each bank can get its own band of qualification criteria https://paydayloanalabama.com/dora/, but the majority imagine items such as your credit score, earnings, payment history and you can DTI proportion . Providing methods to change your credit rating and you may lower most recent personal debt can also be alter your creditworthiness on the sight of lenders.

Positives and negatives from motorboat finance

Watercraft mortgage terms are longer than words private otherwise also auto loans, providing you time for you to repay the borrowed funds

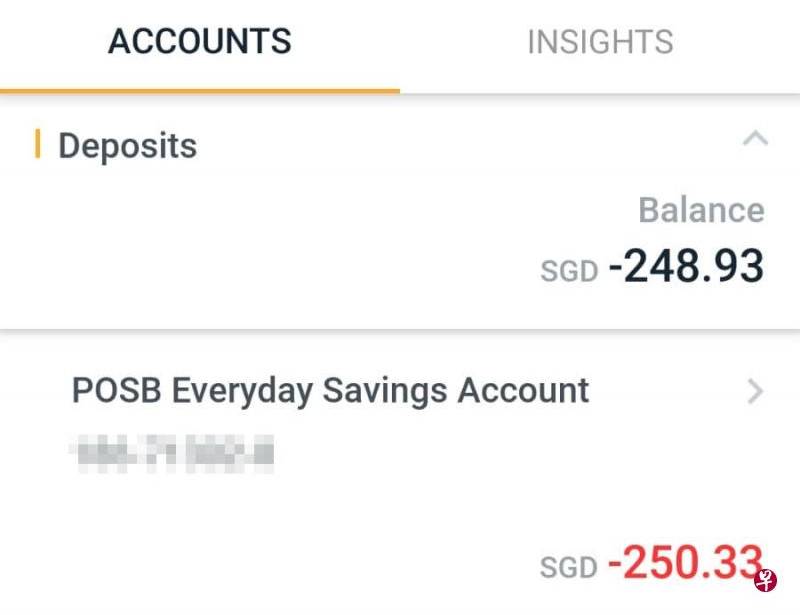

Motorboat viewpoints depreciate rapidly, so you could are obligated to pay more about your own motorboat financing than its worthy of in some age

Selection in order to vessel funds

If you don’t be eligible for a yacht mortgage to possess poor credit , or if perhaps you are interested in that loan that will not need your to place on your boat due to the fact security, you might still has actually options to money your ship. Below are a few solution boat money options:

Having fun with an unsecured unsecured loan to fund the boat purchase happens that have that significant upside: you won’t risk losing your own motorboat (or your home) for many who fall behind on money.

That said, protecting that loan along with your boat will most likely help you to be eligible for straight down interest rates, helping you save profit the near future. As well as keep in mind that personal loans will include origination charges , that could make taking right out that loan more pricey.

As you would not reduce your own boat for people who standard towards a keen unsecured loan , you will deal with consequences such as for example later charges, garnished earnings and you will broken credit.

You need to use a house equity mortgage , otherwise second mortgage, to change the fresh guarantee of your home for cash you are able to use to pay for the boat. Domestic equity loans you certainly will include lower costs than simply you’d shell out that have a personal or ship loan, but there is an enormous catch: for those who standard in your repayments, your home is on the line.

Family collateral credit lines (HELOCs) feature similar benefits to family guarantee fund: you will probably shell out straight down rates of interest, however your domestic might be susceptible to property foreclosure for individuals who cannot build payments on your watercraft. Part of the difference between a beneficial HELOC and you will a home collateral financing is the fact HELOCs means like handmade cards: You could take-out money, pay it off and you can withdraw money once again.

I reviewed our very own LendingTree motorboat financing people to determine the overall greatest five lenders. While making all of our list, loan providers need bring ship finance having competitive APRs. From there, we prioritize loan providers according to research by the after the affairs: