You.S. Places Paying one particular home based Developments

Considering mortgage-level research on Mortgage Revelation Act, how many unmarried-house upgrade finance originated mounted to almost 745,000 when you look at the 2022 just before after that

The following year, though, brand new IMF anticipates the fresh You.S. benefit so you can reduce so you’re able to 2.2% growth. With a brand new presidential government and Congress in place, new IMF envisions the nation’s work as the government begins trying so you can curb grand funds deficits because of the reducing investing, elevating fees or certain combination of both.

The fresh new IMF anticipates China’s monetary increases to help you sluggish off 5.2% last year in order to 4.8% in 2010 and you can cuatro.5% in 2025. The latest earth’s Zero. dos economy could have been hobbled by a failure with its property industry by poor user trust – issues only partly offset by the strong exports.

The 20 Europe you to definitely display the fresh new euro money was collectively expected to eke aside 0.8% progress this year, twice new 2023 expansion regarding 0.4% but a little downgrade regarding 0.9% the brand new IMF got forecast 3 months back getting 2024. The fresh new Italian language benefit, damage of the a beneficial slump from inside the creation and real estate loan places Cherry Hills Village, isn’t really likely to build anyway this year.

Given that interest levels are on their way off and you may likely to help the latest world’s economies, the new IMF informed, the necessity to consist of enormous regulators deficits will likely place a braking system with the increases.

All round globe discount is anticipated to expand step 3.2% in 2024 and you will 2025, off a beneficial tick out of step three.3% this past year. Which is an enthusiastic unimpressive basic: Out of 2000 using 2019, until the pandemic upended monetary passion, around the globe increases averaged step 3.8% a year.

The brand new IMF plus will continue to express matter you to definitely geopolitical pressure, together with antagonism within All of us and you can Asia, make globe change less efficient. The issue is that more places perform much more do business with the partners unlike choosing the reasonable-valued or most readily useful-produced international items.

Nevertheless, all over the world trading, measured from the volume, is expected to enhance step 3.1% this season and you may step three.4% within the 2025, improving toward 2023’s anemic 0.8% boost.

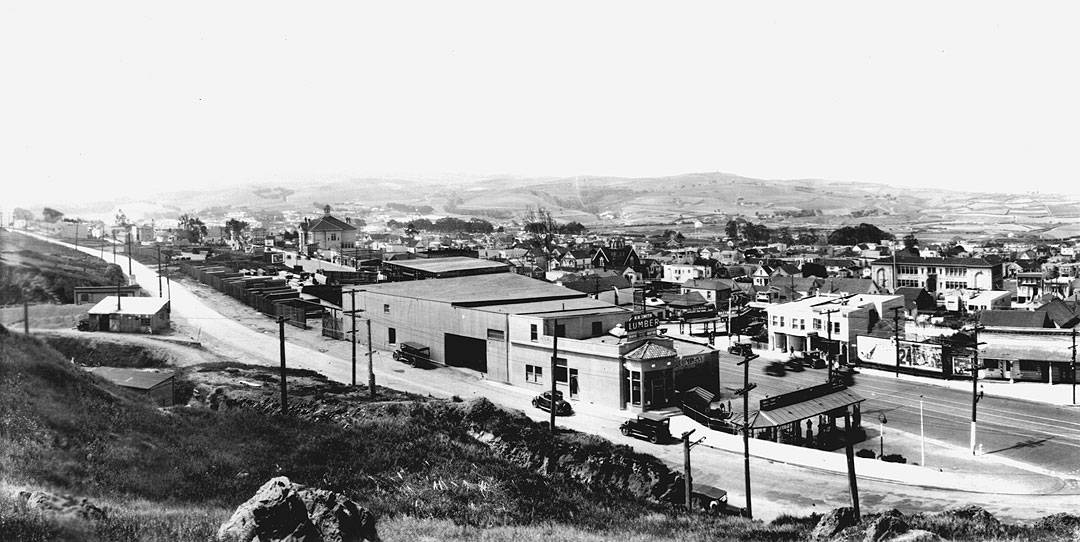

At the beginning of times of new COVID-19 pandemic, property owners all over the country utilized its free time to try out overdue family tactics. As seasons continued, a variety of issues, together with low interest rates and you may rising home prices, aided electricity a surge in home home improvements, developments, and you will remodels.

Such manner proceeded for the 2022, but a combination of financial uncertainty, sluggish house conversion process, and you will rising prices contributed to a small decrease in home improvement paying. However, present investigation on Mutual Heart to possess Houses Studies in the Harvard College or university demonstrates that the new slowdown home based upgrade spending is probably short term hence expenses accounts should trend right up from very first 1 / 2 of 2025.

U.S. Do-it-yourself Spending Throughout the years

After dropping because of the a rising prices-modified 24% off a saturated in 2006 so you can a low last year since the a direct result the nice Credit crunch, do it yourself spending development got in focused ranging from 2012 and you may 2019 while the housing industry retrieved. But not, spending upcoming expanded greatly in peak of your COVID-19 pandemic before plateauing inside 2022 and you will .

Generally speaking, do-it-yourself spending drops through the economic downturns; however, new COVID-19 credit crunch proved to be an exclusion with the laws. You to definitely key need is the fact that first stages of your pandemic disproportionately influenced all the way down-wage professionals have been less likely to want to individual residential property. Meanwhile, higher-earnings home owners didn’t endure an identical number of jobs losses or quicker wages however, benefited of reduced spending on things such as dinner away and you may traveling, hence freed right up fund to other expenditures. With quite a few ones property owners expenses additional time at your home, these people were eager to perform domestic organizations, health clubs, and you will backyard oases presenting decks, outside kitchen areas, and you will swimming pools.