Get an instant Less than perfect credit Re-finance Estimate about Group within BD All over the country

If you need to score cash-out getting paying large appeal financing and you can personal credit card debt, the time has come to help you consolidate the debt. Are you aware that a bad-borrowing home refinance is one of the quickest tips for people to improve their funds circulate?

I’ve aided countless people understand its desires with just minimal payments and reasonable loans getting family repairs, design, 2nd domestic buying not to mention merging consumer debt. See if you meet up with the requirements off home financing refinance getting poor credit.

The fresh Opportunities to Re-finance a mortgage with Fair Borrowing from the bank

There’s been a good amount of explore a great deal more non QM mortgage applications getting offered this season to assist more folks refinance with average fico scores. Of several mortgage lenders enjoys talked about unveiling specific low-accredited home loan apps to include refinancing getting under water mortgages and you can individuals which have less than perfect credit. Oftentimes, the fresh new non QM provides replace subprime re-finance software.

Boosting your Fico scores to possess Refinance Mortgage Poor credit Ventures

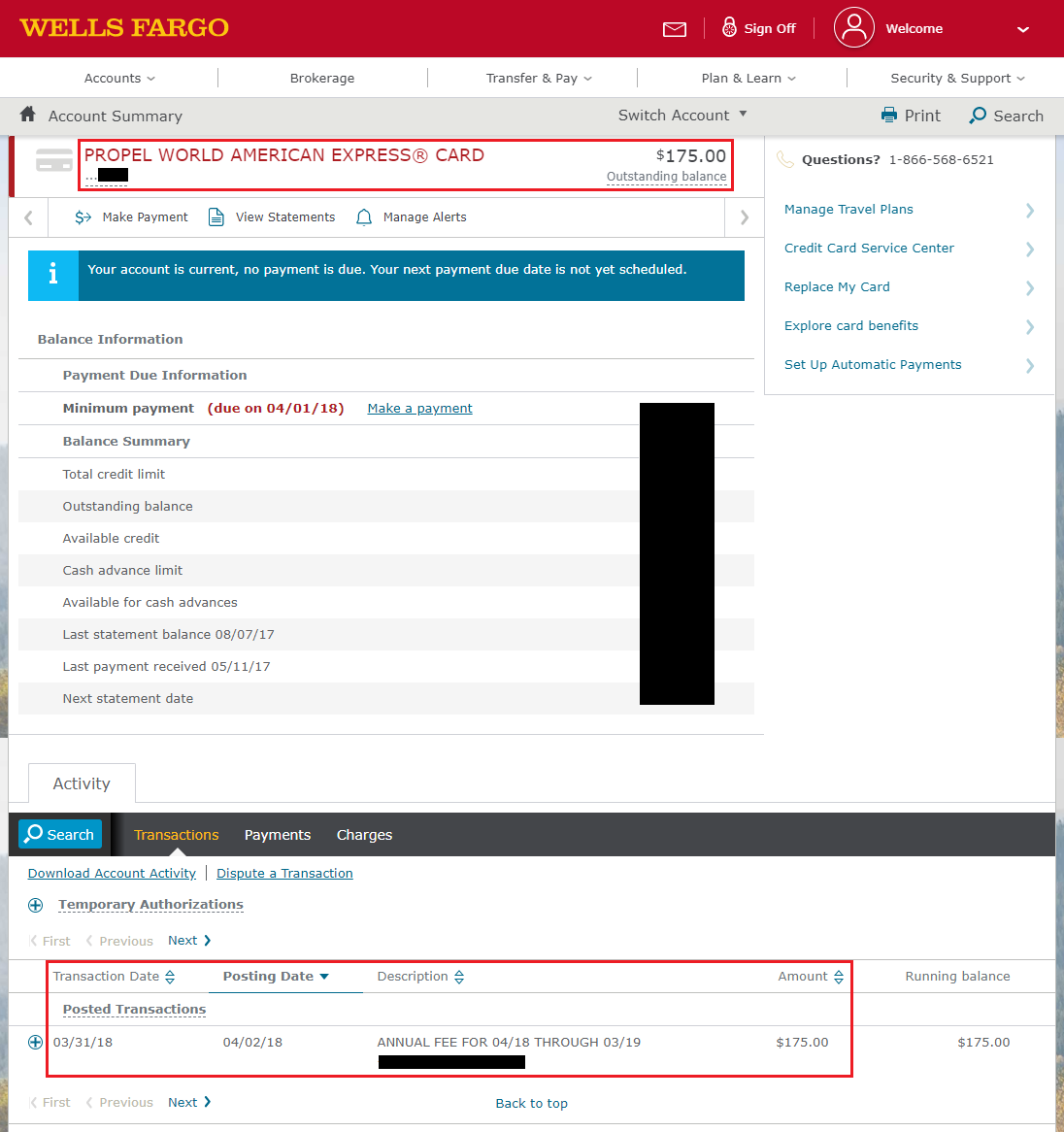

Most home owners see the impression out of failing to pay your own expenses from inside the a prompt trends. When you are late mortgage payment, we provide your own credit scores to drop 50 to help you 100 circumstances. Late financing payments commonly adversely apply at your credit rating. It is reasonably essential for keep the balance to help you good minimum to own rotating credit cards.

Borrowing from the bank experts within the field agree that it’s better to re-finance otherwise pay-from personal credit card debt unlike play video game swinging their a good balances from 1 bank card to a different.

Initiate overseeing and you will enhancing your borrowing from the bank. Before you apply to possess home financing re-finance or any loan, it’s vital to understand the fico scores and you can know what bad marks on the credit history will be holding you back. Begin by requesting your records off and you may overseeing your own results, possibly via your lender or borrowing from the bank union.

Compare Quotes Today and and you can Imagine a mortgage Re-finance with Crappy Borrowing from the bank!

The credit rating model excellent information having users because the Trans Union, Experian and Equifax no more penalize applicants having implementing on the internet to have a mortgage.

Until recently applicants was basically hindered with minimal ratings every time an effective lender went the borrowing. Today users can also be store home loans on line without being concerned about that have its fico scores lower. For more credit history insight check out the Holden Work one to was designed to be sure reasonable lending. Get a no cost Credit report Go online as well as have a good tri-merge credit report free-of-charge. (annualcreditreport)

Only Say NO Loan Program having Refinancing with Lowest Credit scores

- Zero Financial Insurance coverage

- Zero Confirmation Out of Home loan

- Zero Verification Off Rent

- No Confirmation Out-of Put*

- No Property Verification*

- Zero Significance of Income tax & Insurance coverage Impounds

- Zero Bankruptcy proceeding Flavoring

- No Complete Tax returns Needed for Self employed

- No Flavoring From Reserves*

The problem will be based upon searching for mortgage lenders to have less than perfect credit refinancing that provide advantageous interest rates and you will terms. If you’re eg finance companies and you may loan providers do are present, very reserve qualification having individuals which have fair fico scores of 620 and you can over. On the other hand, it restrict the quintessential competitive interest levels so you’re able to individuals that have actually high ratings. Low credit refinancing is possible when you have equity. If you are in a position BD All over the country will help you secure a keen recognition for refinancing mortgage out-of a lender otherwise financial you to definitely top suits you and you will specifications financially.

Less than perfect credit refinance program words and you can interest try at the mercy of alter. Mortgage to help you worthy of and you may minimum credit rating conditions are two critical affairs for the majority financing software.

In the event the mortgage is modifying as well as your payment continues on to increase, then the feeling of necessity is much better in order to refinance than just if for example the financial speed has not yet become change then you have the luxury regarding awaiting better a credit rating or maybe more advantageous interest levels.

Study on The brand new Lending ProsIf there is the capability to establish there exists mistakes on your credit file, you should make an effort to obtain them eliminated. In some instances, rectifying mistakes on the declaration increase your credit score and you will offer the possibilities to be eligible for a less expensive financial refinance which have less than perfect credit.

In statements on proposed advice, NAR often high light the necessity of keeping usage of nontraditional mortgage loans having suitable consumers, especially in large-cost elements. The ability to pursue a property refinance with poor credit are thought to be an assess to attenuate foreclosures and you can mortgage defaults.