How do i do my personal Youngster Trust Fund?

The worth of investment can also be slide including go up, and also you ount your purchase. Any tax efficiencies known are the ones applying less than most recent guidelines, that could transform. Qualification requirements, fees and you will fees pertain.

What is a child Faith Funds?

Youngster Faith Loans is actually long term, tax-100 % free savings makes up about pupils that have been establish because of the Bodies into the 2005. Having an infant Faith Fund is right reports, it means you’ve got a good investment waiting for you when you started to 18.

You will find a baby Trust Loans if you were born ranging from first , unless you, your mother and father or guardians has moved it to your a good Junior ISA.

The cash are committed to a tax-effective financing in your title if you do not turn 18 after you takes control over disregard the and choose to continue purchasing, create a withdrawal otherwise move into a different sort of ISA seller.

The little one Faith Money is purchased the personal Profile Well-balanced Fund that is treated by the gurus during the Coutts & Co.

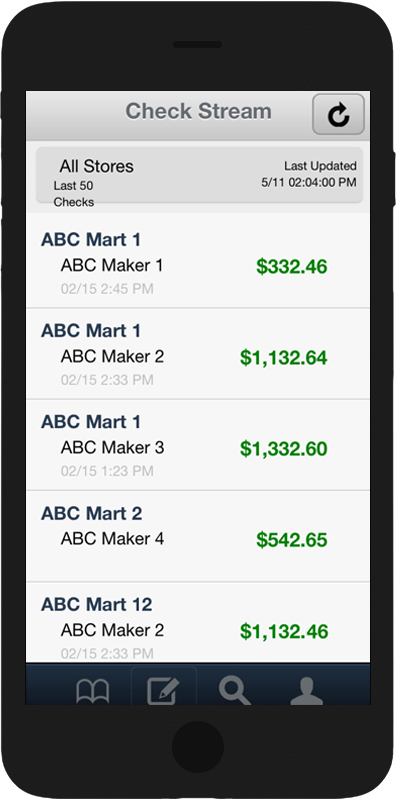

Our online site allows you to check on up on your own Youngster Believe Money, in order to supply forget the after you turn 18.

The newest registered get in touch with (the one who features parental obligation to the youngster) can be register on the portal anytime. The infant usually takes more duty with the account at the sixteen even so they will be unable to gain access to brand new webpage until he is 18.

The new entered get in touch with to possess a free account are able to see the latest worth of one’s membership, best it, set up a direct debit, or tell us when you yourself have changed address.

- your own title

- day of beginning

- consumer membership matter (8-fist count starting with step one try contained on the annual statements, that’s managed to your registered get in touch with).

Where try my personal Child Believe Loans?

Child Faith Financing take place in numerous British banking companies. You can find out in which your youngster Trust Funds is through:

-

New Hampshire personal funding loans

- check in and construct a government portal log on

- the name and you can target

- newborns full name and target

- child’s federal insurance coverage amount otherwise novel site count in the event that recognized.

- little one’s name and you may target

What goes on whenever my Child Trust Finance matures?

We’ll produce for you 20 months ahead of your birthday having facts about disregard the and you can specifics of just how to register for the online webpage.

On your 18th Birthday we will flow your investment in the Youngster Trust Financing into good Matured Youngster Trust Fund, keepin constantly your currency invested in the personal Portfolio Balanced Loans up until you select how to proceed with your money and gives you towards the necessary data.

After joined on the internet, you will be able and also make an alternative regarding your currency. You could choose to continue paying with our team because of the swinging this new resource on a grownup ISA, you can withdraw most of the otherwise section of forget the towards the good United kingdom newest otherwise family savings in your own label, or you can move into another type of ISA vendor.

Almost any alternative you decide on we need to take you due to some even more inspections to ensure their title and you may target. We aim to make the needed suggestions from you on the web, yet not occasionally we must ask you to give copies from documents about post to help with this specific procedure.

If you are being unsure of on what personality files you ought to bring, delight relate to our faq’s below.

Every data files given online, or even in the blog post, will be reviewed by the our team. Please be aware that should you love to withdraw out of your resource, these types of inspections will need to be over in advance of i launch commission to the family savings and that takes around an excellent couple weeks oftentimes.

If you decide to keep the currency invested, that is gone on the matured Youngster Believe Money to the a grownup ISA in 24 hours or less after the bill of knowledge.

Exactly what membership do i need to supply my personal money?

You’ll want to keeps a good Uk newest or checking account inside your own term if you create a withdrawal, so make sure you have that sorted out ahead.

We can just take information throughout the account manager when you change 18 and you’ll need certainly to show their term after you write to us exactly what you would want to do together with your money.

You could always continue to invest around for the a keen Adult ISA, withdraw all of the otherwise section of your money, otherwise move into a unique ISA seller.

Take note it could take doing 2-3 weeks in some instances away from receipt out-of suitable identity and you can withdrawal instruction to possess brand new commission to-be made into your money.

Or even actually have an appropriate membership, you could potentially set one up with many standard banking institutions, building societies, credit unions and/or post-office.