The latest Housing industry Can be so Bad One to Zillow Has to offer People Totally free Money

The fresh Zillow application for the a cellular telephone establish for the Dobbs Ferry, Ny, U.S., towards the Monday, . Zillow Classification Inc. is set to release earnings data may cuatro. Photographer: Tiffany Hagler-Geard/Bloomberg thru Getty Photo Bloomberg thru Getty Photos

W ith mortgage costs during the 21-seasons highs therefore the number of homes sold per month hanging close their reduced point in over 10 years, lenders will probably strange lengths to help you create consumers so you can go into the housing market.

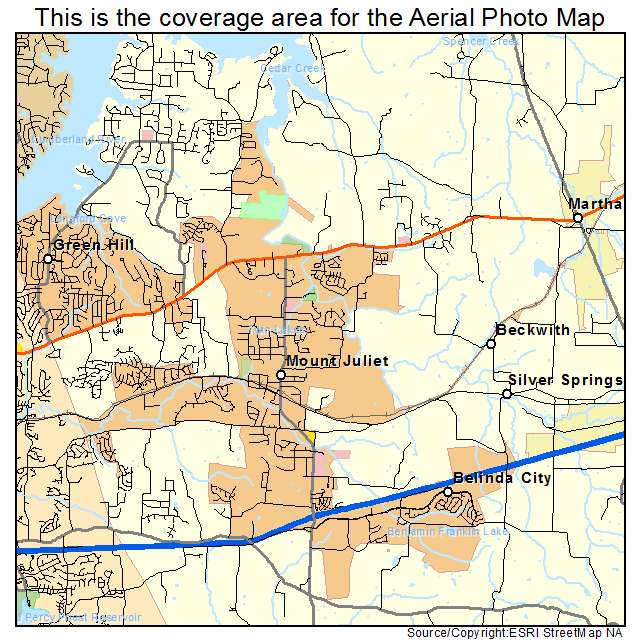

The most eyes-finding gambits is from Zillow, the net a house program, that’s giving new house customers thousands of dollars to greatly help these with their down costs. The application, that organization is piloting in Washington, deliver grants to help you qualified homebuyers well worth dos% of one’s price, reducing its advance payment in order to only step 1%.

Having a thus-named starter house in the Washington you to definitely costs $275,000-an illustration Zillow offers with its press release declaring the program-that means a give of $5,500.

Given that Zillow economist Orphe Divounguy shows you they, the business can offer an equivalent advice potential home purchasers tend to discover using their moms and dads. Inside the an atmosphere in which credit try tight, you have got clients that are using essentially as frequently, if not more, when you look at the book than simply they will shell out to have, Divounguy states. This might be form of the ideal time so you’re able to part of right here and help anyone who has been sidelined because of the fact that they do not have usage of parental household security.

Zillow spokespeople wouldn’t say how much they wants to hand out in advance payment guidance, nor just what it expects is the measurements of the typical personal grant, however the company really does desire to roll out the plan nationwide. Since the program is limited so you can earliest-go out buyers with earnings below the average in the region, brand new provides try unrealistic installment loans for bad credit in Hamilton Mississippi to get over $10,000.

High rates, lower inventory

Just 4.04 mil existing property was purchased in August regarding the U.S., the newest poor matter your , according to Federal Association off Real estate agents. Considering realtors and housing market observers, the newest slow marketplace is passionate just from the higher rates, but a dearth out-of available belongings. The shortage try a product or service from a good pandemic-relevant slowdown in the design together with unwillingness regarding existing property owners to surrender low home loan rates it secured in years past.

It’s a mystical, unusual business, states Butch Leiber, a realtor and you can president of one’s Phoenix Realtors panel regarding administrators. I’ve super, super low list. Because the rates ran upwards, i saw visitors hobby miss. The issue is, thus did seller passion. If they have a home loan, he has got an effective 3%, 4%, 5% financial and should not move. An average 30-12 months fixed interest rate was 8.07% since October. 16, considering Investopedia.

To help you encourage buyers, domestic developers also are trying decrease the price of borrowing from the bank. If you’re Zillow is offering down-payment direction, builders try lowering rates of interest to possess customers by the purchasing off home loan costs. Basically, they are investing a lender or mortgage creator a-one-big date payment in return for a lesser interest rate. Given that greatest domestic designers, eg Lennar and you can Pulte, together with very own mortgage origination companies, they deal with smaller economic coverage.

If you find yourself Zillow is not a property creator, it also is wanting to capture as frequently of real property , Seattle-mainly based Zillow began as the an online a property research and you can listings solution. It offers as offered to add managing accommodations, brokering accommodations, and you may connecting people and you can manufacturers which have representatives. In 2018, it obtained Mortgage lenders out-of America to get in the house-money team. Predicated on Zillow Chief executive officer and you will co-maker Rich Barton, the firm is designed to twice the express of all the You.S. real estate deals away from step three% so you’re able to 6% because of the 2025.

Entering the “Zillow ecosphere”

By the providing potential home buyers take-out mortgages, Zillow hair all of them for the its room away from a home products and features, Leiber says. If they have them toward Zillow ecosphere, they shall be associated with Zillow for quite some time, according to him.

Doing bonuses having low-earnings homebuyers to look at personal debt evokes brand new specter out-of the subprime mortgage problems that helped produce the all over the world overall economy out-of 2008. But not, Zillow professionals say the program is absolutely nothing for instance the higher-chance mortgage loans accessible to unqualified consumers nearly two decades before.

This isn’t 2006, 2007, Divounguy says. This can be a traditional 30-12 months fixed loan, where prospective buyers must satisfy every usual certificates, common conditions. Further, according to him, there are plenty of well-accredited consumers trying to find residential property, Zillow does not have any so you’re able to loan so you’re able to unqualified consumers. Financial delinquency prices was all the way down now than they certainly were before the pandemic or nearly any moment inside the submitted history, Divounguy says. Credit ratings of the latest homebuyers are close its high level due to the fact we’ve been tape those.

While you are Zillow’s system try uncommon for the reason that off-percentage help is from a loan provider, there are many different eg software run because of the governments and you will nonprofits to help you help very first-date homebuyers, particularly those in this new armed forces otherwise men and women off disadvantaged groups.

Before typing one program, it seems sensible to speak with property-to order specialist, claims Jackie Boies, a casing professional at Money Management Global, good nonprofit that gives counseling certainly a variety of monetary studies software. Because there is absolutely nothing inherently skeptical on the down-payment recommendations, people want to do lots of homework, she claims. In the event it songs too good to be real, they most likely is.