Profitability Ratio With Examples Gross Profit, Operating Ratio

Also, investors can monitor operating expenses and cost of goods sold (or cost of sales) separately to determine whether costs are either increasing or decreasing over time. It helps the management and analysts understand if the company is efficient enough to manage all of its expenses against its total turnover. This occurs when operating expenses are greater than net sales revenue over a given period. There are five scenarios where an operating ratio over 100% arises for a public company whose stock is traded on exchanges. The key ways operating ratios are used by stock analysts and investors include assessing profitability, measuring efficiency, estimation valuation, assessing management performance, identifying issues, etc. An operating ratio of less than 1.0 means the company is generating an operating profit, while a ratio higher than 1.0 means the company is operating at a loss.

Comparing Operating Ratios Across Industries

A constant operating ratio refers to a company maintaining a relatively stable ratio of operating expenses to net sales over an extended period of time. This measure provides insight into the cost efficiency and operating leverage of a business. For investors and analysts evaluating stocks, tracking the trend in a company’s operating Ratio sometimes reveals much about the sustainability of its performance. Delving into the key components of the operating ratio reveals the intricate balance between various operational costs and revenue streams. At the heart of this metric are operating expenses, which encompass a broad spectrum of costs. These include direct costs such as raw materials and labor, as well as indirect costs like administrative expenses and depreciation.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

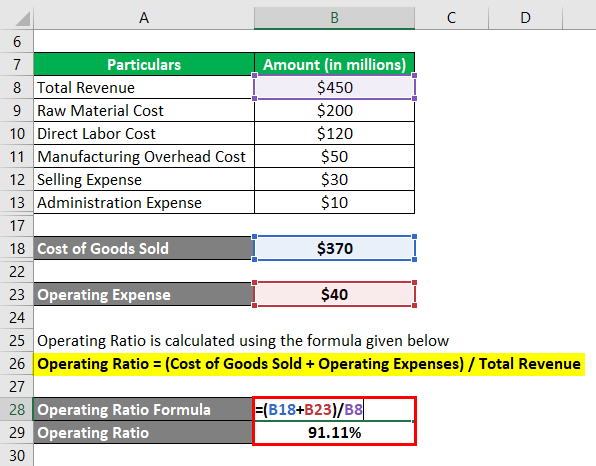

These are the day-to-day expenses necessary to keep the business running. Net sales, on the other hand, represent the total revenue generated from goods sold or services provided, minus returns, allowances, and discounts. By focusing on these two elements, the operating ratio provides a clear picture of the relationship between costs and revenue. The following steps are to be undertaken to calculate the operating ratio in case the operating expenses include the cost of goods sold. Return on sales (ROS) is a profitability ratio which reflects how efficient an organization is in utilizing its total assets to generate revenues.

Sample Financial Statements

- This reflects positively on management’s ability to run the business efficiently and usually leads to a higher stock valuation.

- Though the operating Ratio remains high, the slight reduction indicates Tata Motors’ continued efforts to manage costs effectively despite significant increases in both revenue and expenses.

- Investing in employee training and development can enhance productivity and reduce errors, leading to more efficient operations.

- Therefore, it is crucial to have a firm grasp on the most basic ratios, such as working capital.

Let us understand the operating ratio with the help of a solved example. We will use the following sample financial statements as the example for all of our ratios. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website.

Profitability Ratios

The cost of goods sold components consist of factors like opening stock, direct expenses, manufacturing expenses and closing stock. A higher ratio would indicate that expenses are more than the company’s ability to generate sufficient revenue and may be considered inefficient. Similarly, a relatively low ratio would be considered a good sign as the company’s expenses are less than that of its revenue. Liquidity describes whether or not your company can quickly convert its assets into cash to meet its short-term financial obligations. A highly liquid company has ample cash or assets that can be easily sold without a significant loss in value. When you’re in the weeds of running your business each day, it can be difficult to zoom out and see how well your company is performing.

What is your current financial priority?

Profitability is perhaps the most important financial calculation you can make. Entrepreneurs and industry leaders share their best advice on how to take your company to the next level. Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, job order costing vs process costing similarities and differences Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Moreover, earning profit is considered essential for business prosperity. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Learning from industry leaders can provide actionable insights that drive improvements in a company’s own operations. Indirect costs, while not directly tied to production, are equally important. These can include administrative salaries, office supplies, and utilities.